Menu

Perceptrader AI建立在Waka Waka成熟的交易策略之上,并与ChatGPT和Google的Bard无缝集成,以实现准确的预测,为交易者提供智能决策能力。

交易理念

Perceptrader AI是一个尖端的网格交易系统,利用人工智能的力量,利用深度学习算法和人工神经网络(ANN)高速分析大量市场数据并检测高可以利用的潜在贸易机会。

规格

执照

10 个 MetaTrader 4 或 5 账户的终身许可证,具有 3 个不同的交易集和用户仪表板访问权限。

经纪商/VPS推荐

Perceptrader AI 对经纪商选择不敏感,您可以通过经纪商选择来实现投资多元化和规模化。为了获得最佳的稳定性和盈利能力,我们建议在 Tickmill, and IC Markets 外汇经纪商 上与 TradingFX VPS 结合使用它link][/top-forex-vps.html][外汇 VPS][df]。

MT5 兼容性

Perceptrader AI 的 MT5 版本现已推出。

更新

包括未来终身免费更新。

用户指南

- 易于观看的“如何安装”视频。

- 战略和风险管理指南。

客户支持

- 访问专属 Telegram 群组。

- 来自开发人员的一对一支持 (Valeriia)。

- 远程桌面配置。

免费奖金

- 波动率过滤指标。

- 6 个月的 ValeryVPS。

退款政策

在极不可能的情况下,您不喜欢 Perceptrader AI,EA 供应商 - 确保她愿意立即退还您支付给她的每一分钱,并且不问任何问题。

不仅如此,她还承诺为您提供长达 30 天的令人难以置信的保证(而 MQL market 只提供 7 天,而大多数专家顾问销售网站根本不提供它)。

支持的货币对

NZDUSD, USDCAD, AUDCAD, AUDNZD, NZDCAD, and GBPCHF.

MetaTrader 图表时间框架

M5

MyFxBook 验证真实货币交易结果

实时测试摘要

开始于

May 28, 2023

账户杠杆

1:300

利润因子

1.85

总收益

+218.73%

绝对收益

+165.04%

月收益

3.78%

日收益

0.12%

总点数

1,918.1

总交易

921

利润金额

$1,155.31

(%) 赢交易

1,918.1

回撤

65.44%

实时测试摘要

开始于

Aug 01, 2019

账户杠杆

1:300

利润因子

1.51

总收益

+330.57%

绝对收益

+273.30%

月收益

1.90%

日收益

0.06%

总点数

-1,701.1

总交易

6,233

利润金额

$13,665.22

(%) 赢交易

-1,701.1

回撤

21.96%

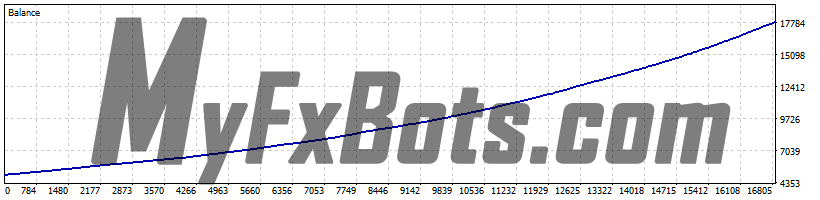

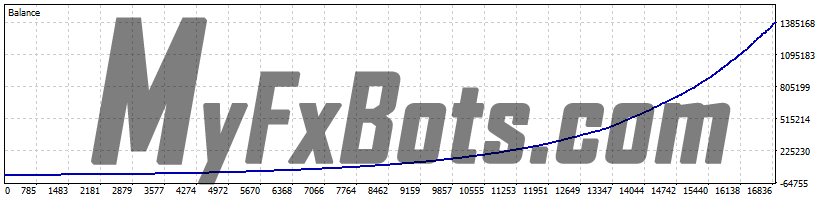

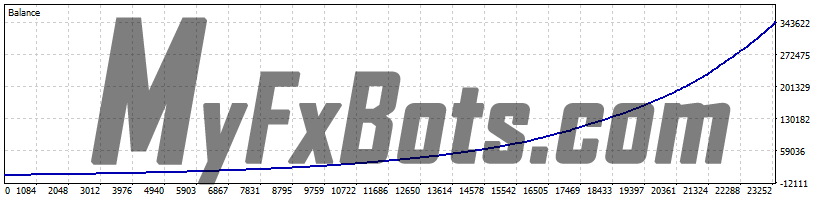

MT5 策略测试器 100% 质量 Tick 数据回测

标准交易

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

12 919.39

总盈利

22 519.30

总亏损

-9 599.91

盈利因子

2.35

预期收益

1.54

保证金水平

6643.68%

绝对余额回撤

0.94

最大余额回撤

151.75 (1.24%)

相对余额回撤

1.31% (81.71)

绝对净值回撤

25.17

最大净值回撤

326.96 (2.67%)

相对净值回撤

2.99% (186.25)

恢复因子

39.51

夏普比率

4.36

Z值

-1.62 (89.48%)

AHPR

1.0002 (0.02%)

线性回归相关性

0.98

OnTester结果

0

GHPR

1.0002 (0.02%)

线性回归标准误差

752.99

总交易数

8392

空头头寸

3705 (72.85%)

多头头寸

4687 (70.92%)

盈利交易

6023 (71.77%)

亏损交易

2369 (28.23%)

最大盈利交易

155.53

最大亏损交易

-63.41

平均盈利交易

3.74

平均亏损交易

-3.77

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

5 (-80.44)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-150.98 (3)

平均连续盈利次数

-

平均连续亏损次数

1

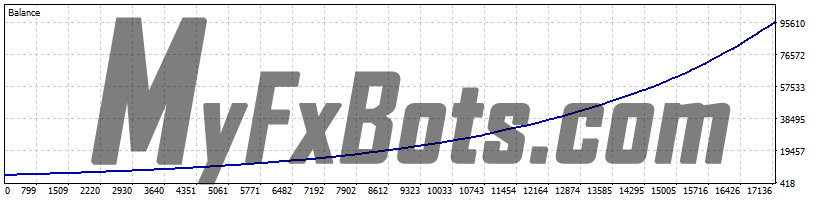

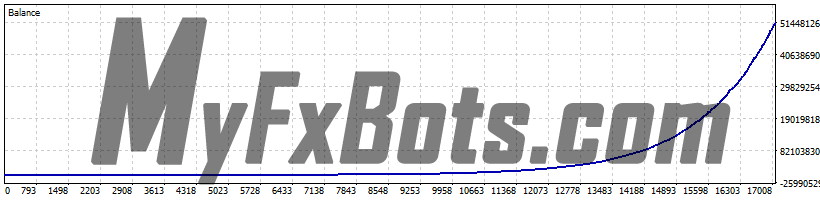

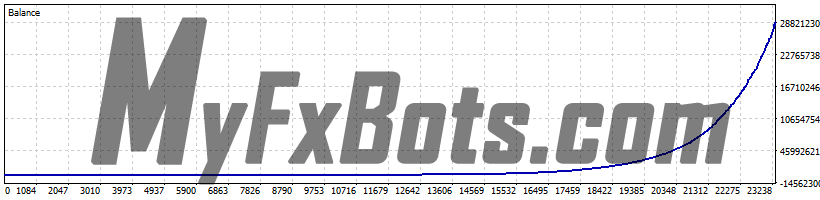

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747896

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

91 378.63

总盈利

164 425.46

总亏损

-73 046.83

盈利因子

2.25

预期收益

10.68

保证金水平

3069.23%

绝对余额回撤

3.33

最大余额回撤

1 067.12 (1.38%)

相对余额回撤

1.77% (307.46)

绝对净值回撤

13.57

最大净值回撤

2 608.80 (3.37%)

相对净值回撤

9.58% (1 668.22)

恢复因子

35.03

夏普比率

3.98

Z值

-2.17 (97.00%)

AHPR

1.0003 (0.03%)

线性回归相关性

0.93

OnTester结果

0

GHPR

1.0003 (0.03%)

线性回归标准误差

9 233.77

总交易数

8557

空头头寸

3754 (71.52%)

多头头寸

4803 (70.60%)

盈利交易

6076 (71.01%)

亏损交易

2481 (28.99%)

最大盈利交易

1 014.00

最大亏损交易

-490.28

平均盈利交易

27.06

平均亏损交易

-27.49

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-307.46)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-1 040.72 (3)

平均连续盈利次数

-

平均连续亏损次数

1

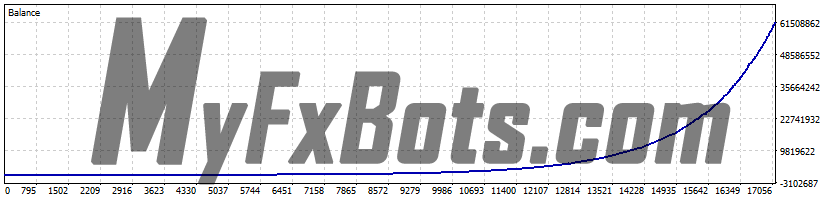

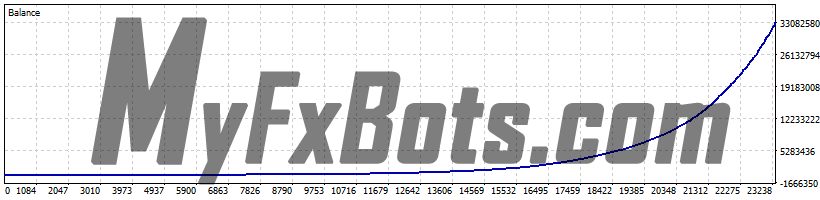

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

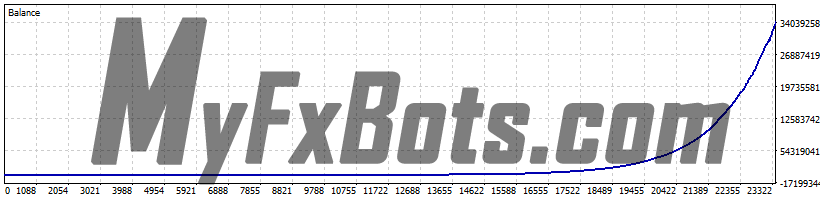

总净利润

61 786 342.50

总盈利

109 916 694.25

总亏损

-48 130 351.75

盈利因子

2.28

预期收益

7 254.47

保证金水平

1708.91%

绝对余额回撤

12.27

最大余额回撤

1 086 770.34 (1.91%)

相对余额回撤

9.13% (431 972.25)

绝对净值回撤

69.71

最大净值回撤

2 736 338.78 (4.82%)

相对净值回撤

19.59% (925 869.64)

恢复因子

22.58

夏普比率

4.14

Z值

-1.44 (85.01%)

AHPR

1.0011 (0.11%)

线性回归相关性

0.70

OnTester结果

0

GHPR

1.0011 (0.11%)

线性回归标准误差

8 934 341.14

总交易数

8517

空头头寸

3698 (72.23%)

多头头寸

4819 (70.55%)

盈利交易

6071 (71.28%)

亏损交易

2446 (28.72%)

最大盈利交易

1 061 292.77

最大亏损交易

-688 023.61

平均盈利交易

18 105.20

平均亏损交易

-18 324.06

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-338 681.83)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-1 086 770.34 (2)

平均连续盈利次数

-

平均连续亏损次数

1

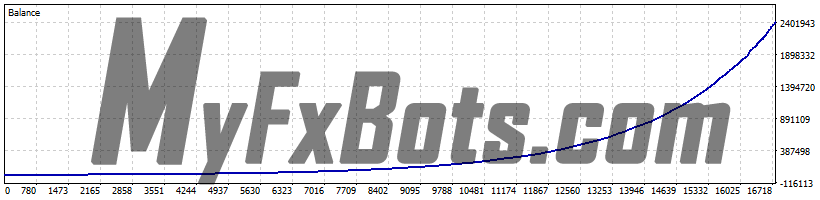

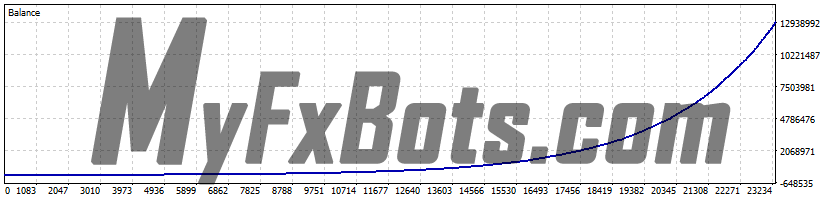

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

2 422 260.25

总盈利

4 194 024.42

总亏损

-1 771 764.17

盈利因子

2.37

预期收益

290.16

保证金水平

2239.87%

绝对余额回撤

0.08

最大余额回撤

32 668.90 (1.50%)

相对余额回撤

2.69% (833.51)

绝对净值回撤

28.84

最大净值回撤

124 454.91 (6.57%)

相对净值回撤

11.95% (3 702.84)

恢复因子

19.46

夏普比率

4.38

Z值

-1.01 (68.75%)

AHPR

1.0007 (0.07%)

线性回归相关性

0.81

OnTester结果

0

GHPR

1.0007 (0.07%)

线性回归标准误差

332 514.38

总交易数

8348

空头头寸

3527 (72.89%)

多头头寸

4821 (71.21%)

盈利交易

6004 (71.92%)

亏损交易

2344 (28.08%)

最大盈利交易

37 344.24

最大亏损交易

-21 179.36

平均盈利交易

698.54

平均亏损交易

-701.48

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-1 441.12)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-32 168.92 (3)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

1 394 746.18

总盈利

2 439 417.01

总亏损

-1 044 670.83

盈利因子

2.34

预期收益

165.90

保证金水平

1711.22%

绝对余额回撤

17.00

最大余额回撤

17 242.44 (1.77%)

相对余额回撤

4.00% (13 215.30)

绝对净值回撤

138.21

最大净值回撤

58 957.84 (8.78%)

相对净值回撤

8.78% (58 957.84)

恢复因子

23.66

夏普比率

4.29

Z值

0.29 (22.05%)

AHPR

1.0007 (0.07%)

线性回归相关性

0.85

OnTester结果

0

GHPR

1.0007 (0.07%)

线性回归标准误差

182 468.62

总交易数

8407

空头头寸

3638 (71.72%)

多头头寸

4769 (70.79%)

盈利交易

5985 (71.19%)

亏损交易

2422 (28.81%)

最大盈利交易

16 628.43

最大亏损交易

-8 325.65

平均盈利交易

407.59

平均亏损交易

-402.17

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-13 229.45)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-16 894.23 (3)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747896

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

518 619 576.79

总盈利

901 753 420.09

总亏损

-383 133 843.30

盈利因子

2.35

预期收益

61 064.36

保证金水平

821.44%

绝对余额回撤

10.31

最大余额回撤

9 807 882.61 (2.20%)

相对余额回撤

8.09% (2 249 099.82)

绝对净值回撤

74.27

最大净值回撤

38 015 374.11 (9.73%)

相对净值回撤

26.59% (361 990.36)

恢复因子

13.64

夏普比率

4.21

Z值

-1.05 (70.63%)

AHPR

1.0014 (0.14%)

线性回归相关性

0.68

OnTester结果

0

GHPR

1.0014 (0.14%)

线性回归标准误差

76 361 080.01

总交易数

8493

空头头寸

3695 (72.69%)

多头头寸

4798 (72.18%)

盈利交易

6149 (72.40%)

亏损交易

2344 (27.60%)

最大盈利交易

10 885 735.43

最大亏损交易

-5 889 686.80

平均盈利交易

146 650.42

平均亏损交易

-152 030.79

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

5 (-2 197 137.72)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-9 710 147.97 (3)

平均连续盈利次数

-

平均连续亏损次数

1

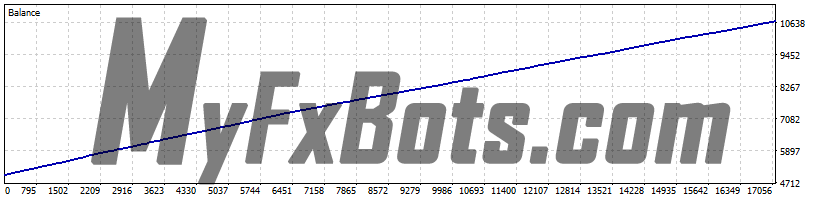

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

5 694.50

总盈利

9 935.00

总亏损

-4 240.50

盈利因子

2.34

预期收益

0.67

保证金水平

10346.75%

绝对余额回撤

3.36

最大余额回撤

36.08 (0.57%)

相对余额回撤

0.57% (36.08)

绝对净值回撤

13.65

最大净值回撤

133.96 (1.72%)

相对净值回撤

1.72% (133.96)

恢复因子

42.51

夏普比率

3.95

Z值

-0.87 (61.57%)

AHPR

1.0001 (0.01%)

线性回归相关性

1.00

OnTester结果

0

GHPR

1.0001 (0.01%)

线性回归标准误差

53.95

总交易数

8518

空头头寸

3668 (71.62%)

多头头寸

4850 (70.54%)

盈利交易

6048 (71.00%)

亏损交易

2470 (29.00%)

最大盈利交易

37.68

最大亏损交易

-10.90

平均盈利交易

1.64

平均亏损交易

-1.60

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-35.47)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-35.47 (4)

平均连续盈利次数

-

平均连续亏损次数

1

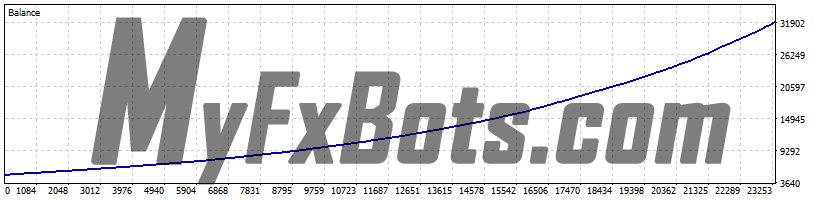

独特的交易

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

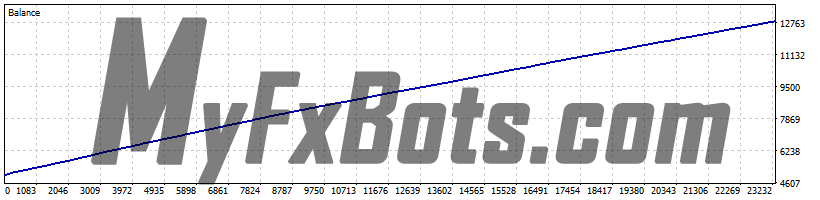

回测结果

总净利润

27 185.98

总盈利

45 901.88

总亏损

-18 715.90

盈利因子

2.45

预期收益

2.34

保证金水平

4984.04%

绝对余额回撤

0.81

最大余额回撤

180.70 (0.98%)

相对余额回撤

1.34% (80.56)

绝对净值回撤

5.61

最大净值回撤

549.68 (1.93%)

相对净值回撤

4.57% (274.10)

恢复因子

49.46

夏普比率

4.35

Z值

-2.61 (99.09%)

AHPR

1.0002 (0.02%)

线性回归相关性

0.96

OnTester结果

0

GHPR

1.0002 (0.02%)

线性回归标准误差

2 100.11

总交易数

11612

空头头寸

5181 (74.50%)

多头头寸

6431 (71.95%)

盈利交易

8487 (73.09%)

亏损交易

3125 (26.91%)

最大盈利交易

164.44

最大亏损交易

-72.90

平均盈利交易

5.41

平均亏损交易

-5.55

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

5 (-79.29)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-176.46 (4)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747896

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

342 198.44

总盈利

578 676.14

总亏损

-236 477.70

盈利因子

2.45

预期收益

29.47

保证金水平

3254.29%

绝对余额回撤

0.81

最大余额回撤

2 143.22 (0.62%)

相对余额回撤

1.98% (2 065.00)

绝对净值回撤

5.61

最大净值回撤

10 693.48 (4.00%)

相对净值回撤

8.90% (2 277.25)

恢复因子

32.00

夏普比率

4.53

Z值

-2.40 (98.36%)

AHPR

1.0004 (0.04%)

线性回归相关性

0.88

OnTester结果

0

GHPR

1.0004 (0.04%)

线性回归标准误差

41 611.55

总交易数

11611

空头头寸

5183 (74.42%)

多头头寸

6428 (72.06%)

盈利交易

8489 (73.11%)

亏损交易

3122 (26.89%)

最大盈利交易

2 495.70

最大亏损交易

-1 581.32

平均盈利交易

68.17

平均亏损交易

-70.15

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-2 016.60)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-2 137.39 (3)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747896

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

2 912 560 100.93

总盈利

4 919 168 381.36

总亏损

-2 006 608 280.43

盈利因子

2.45

预期收益

250 996.22

保证金水平

973.08%

绝对余额回撤

3.23

最大余额回撤

53 517 277.20 (1.86%)

相对余额回撤

5.99% (4 731 951.43)

绝对净值回撤

22.43

最大净值回撤

188 736 423.97 (6.55%)

相对净值回撤

27.10% (294 604.16)

恢复因子

15.43

夏普比率

4.46

Z值

-2.47 (98.61%)

AHPR

1.0012 (0.12%)

线性回归相关性

0.61

OnTester结果

0

GHPR

1.0011 (0.11%)

线性回归标准误差

405 169 216.31

总交易数

11604

空头头寸

5176 (74.48%)

多头头寸

6428 (72.01%)

盈利交易

8484 (73.11%)

亏损交易

3120 (26.89%)

最大盈利交易

62 319 460.95

最大亏损交易

-39 486 596.30

平均盈利交易

579 817.11

平均亏损交易

-594 465.15

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-4 621 043.43)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-51 968 092.86 (3)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

33 426 957.40

总盈利

56 693 967.03

总亏损

-23 267 009.63

盈利因子

2.44

预期收益

2 880.64

保证金水平

1535.00%

绝对余额回撤

2.41

最大余额回撤

411 274.00 (1.24%)

相对余额回撤

3.99% (120 003.08)

绝对净值回撤

16.82

最大净值回撤

1 587 920.85 (8.00%)

相对净值回撤

18.05% (31 042.51)

恢复因子

21.05

夏普比率

4.51

Z值

-2.55 (98.89%)

AHPR

1.0008 (0.08%)

线性回归相关性

0.72

OnTester结果

0

GHPR

1.0008 (0.08%)

线性回归标准误差

4 799 132.52

总交易数

11604

空头头寸

5175 (74.49%)

多头头寸

6429 (72.02%)

盈利交易

8485 (73.12%)

亏损交易

3119 (26.88%)

最大盈利交易

478 917.75

最大亏损交易

-303 449.86

平均盈利交易

6 681.67

平均亏损交易

-6 903.04

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-117 190.43)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-399 368.70 (3)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747896

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

13 070 605.79

总盈利

22 072 438.62

总亏损

-9 001 832.83

盈利因子

2.45

预期收益

1 126.58

保证金水平

1681.75%

绝对余额回撤

4.04

最大余额回撤

155 254.85 (1.29%)

相对余额回撤

2.58% (48 863.35)

绝对净值回撤

28.04

最大净值回撤

434 649.91 (5.00%)

相对净值回撤

12.01% (20 854.81)

恢复因子

30.07

夏普比率

4.67

Z值

-2.61 (99.09%)

AHPR

1.0007 (0.07%)

线性回归相关性

0.78

OnTester结果

0

GHPR

1.0007 (0.07%)

线性回归标准误差

1 858 316.18

总交易数

11602

空头头寸

5178 (74.45%)

多头头寸

6424 (72.03%)

盈利交易

8482 (73.11%)

亏损交易

3120 (26.89%)

最大盈利交易

170 687.40

最大亏损交易

-82 217.12

平均盈利交易

2 602.27

平均亏损交易

-2 673.80

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-47 718.11)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-152 932.31 (3)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747036

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

34 398 788 712.70

总盈利

57 513 147 439.47

总亏损

-23 114 358 726.77

盈利因子

2.49

预期收益

2 953 699.87

保证金水平

784.77%

绝对余额回撤

8.08

最大余额回撤

754 066 843.08 (2.57%)

相对余额回撤

5.16% (36 949 483.68)

绝对净值回撤

56.06

最大净值回撤

1 973 619 201.31 (6.52%)

相对净值回撤

23.96% (1 444 734.96)

恢复因子

17.43

夏普比率

4.61

Z值

-2.72 (99.35%)

AHPR

1.0014 (0.14%)

线性回归相关性

0.60

OnTester结果

0

GHPR

1.0014 (0.14%)

线性回归标准误差

4 874 413 368.76

总交易数

11646

空头头寸

5193 (74.47%)

多头头寸

6453 (72.09%)

盈利交易

8519 (73.15%)

亏损交易

3127 (26.85%)

最大盈利交易

353 712 280.01

最大亏损交易

-399 529 645.37

平均盈利交易

6 751 161.81

平均亏损交易

-6 835 395.15

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

4 (-742 779 647.21)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-742 779 647.21 (4)

平均连续盈利次数

-

平均连续亏损次数

1

回测设置

交易品种

AUDCAD_Duka

周期

M5 (2010.01.01 - 2025.01.01)

经纪商

货币

USD

杠杆

1:500

交易品种

6

测试中的K线数

1043838

模拟的Tick数

307747896

建模质量

100% real ticks

初始资金

$5 000.00

回测结果

总净利润

7 844.71

总盈利

13 269.53

总亏损

-5 424.82

盈利因子

2.45

预期收益

0.68

保证金水平

4982.97%

绝对余额回撤

0.81

最大余额回撤

80.56 (1.34%)

相对余额回撤

1.34% (80.56)

绝对净值回撤

5.61

最大净值回撤

274.10 (4.57%)

相对净值回撤

4.57% (274.10)

恢复因子

28.62

夏普比率

3.99

Z值

-2.59 (99.04%)

AHPR

1.0001 (0.01%)

线性回归相关性

1.00

OnTester结果

0

GHPR

1.0001 (0.01%)

线性回归标准误差

81.11

总交易数

11602

空头头寸

5185 (74.46%)

多头头寸

6417 (71.92%)

盈利交易

8476 (73.06%)

亏损交易

3126 (26.94%)

最大盈利交易

74.11

最大亏损交易

-21.23

平均盈利交易

1.57

平均亏损交易

-1.61

最大连续盈利次数(以金额计)

-

最大连续亏损次数(以金额计)

5 (-79.29)

最大连续盈利次数(以笔数计)

-

最大连续亏损次数(以笔数计)

-79.29 (5)

平均连续盈利次数

-

平均连续亏损次数

1

交易策略

- 由人工智能技术提供支持:

- 机器学习/深度学习/感知器。

- 与大型语言模型 (LLM) 集成: ChatGPT / Bard 算法允许在出现重大趋势变动的可能性较高的情况下跳过交易。与Waka Waka相比,它还应该巧妙地使系统更安全。

- 利用并允许训练神经网络。

- 利用价格预测模型、数学计算和大数据。

- 基于Waka Waka经过验证的策略:它具有类似的交易逻辑,但利用人工智能为高潜在利润交易添加额外的过滤层。

- 它融合了最新的AI 技术,但底层 EA 在此版本发布之前已经开发多年。

- 在本评论更新之前已连续 48 个月盈利,这可以在MyFxBook和MQL5 实时信号上得到验证。

- 它有一个称为“独特交易”的功能 - 因为每个交易者每次运行时都会提供独特的交易。没有交易者会得到完全相同的交易。这使得它不会出现Waka Waka可能出现的问题,因为很多人使用它,并且价格因此从TP水平反转。

这一切对你意味着什么

所有这些与人工智能相关的奇特词汇听起来都令人惊叹,虽然技术进步是真实的,但其他一些不诚实的玩家正在利用它们来利用无辜的交易者,他们不想被排除在最新趋势之外。

真正重要的是他们如何帮助您获得更好的交易结果。通过Perceptrader AI ,您将能够利用行业领先的人工智能技术的力量,因为:

- 您将从最新的人工智能驱动的交易技术中获利。

- 您将使用尖端的深度学习算法进行交易。

- 您将教神经网络快速有效地对数据进行排序。

- 您将根据准确的价格预测做出明智的决策。

- 您将使用强大的数学和复杂的计算来指导您的交易。

- 您将研究过去的市场数据以改善未来的交易。

- 这一切都会自动发生,24/7,无需您动一根手指。

促销视频(由供应商提供)

来自 Valery Trading 的其他外汇机器人

表现最高的黄金 EA 都具有相同的共同逻辑: 网格交易 。

Valery Trading EA 开发团队开发了排名第一的网格交易 EA,称为 Waka Waka,并且然后他们将 Waka Waka 中的许多算法原理应用到这个 gold EA,结果令人惊叹:Golden Pickaxe性能甚至比 Waka Waka 更好。

Perceptrader AI是一个尖端的网格交易系统,利用人工智能的力量,利用深度学习算法和人工神经网络(ANN)高速分析大量市场数据并检测高可以利用的潜在贸易机会。

投资由新闻事件驱动的日内季节性波动模式是 News Catcher PRO 的目标,这是一种复杂的均值 回归交易策略。

News Catcher PRO默认不使用鞅或网格(可选网格可用)。

标签

Valery Trading

Tickmill

Algocrat AI

FXAutomater

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

Waka Waka

FBS

IC Markets

Perceptrader AI

Forex Diamond

HF Markets

RoboForex

StrategyQuant X

Volatility Factor Pro

XM

InstaForex

Alpari

Forex Combo System

GPS Forex Robot

FX Scalper

GrandCapital

Golden Pickaxe

Automated Forex Tools

Forex Trend Detector

AMarkets

IronFX

Omega Trend

Telegram Signal Copier

Broker Arbitrage

SMRT Algo

Quant Analyzer

Forex Trend Hunter

Binance

FXVM

TradingFX VPS

Gold Miner

ForexSignals.com

AlgoWizard

RayBOT

FxPro

Forex Gold Investor

ACY Securities

Gold Scalper PRO

Libertex

Quant Data Manager

FXCharger

FX Choice

News Scope EA PRO

Smart Scalper PRO

Commercial Network Services

FX-Builder

Infinity Trader

Pump Trader Robot

Happy Forex

LeapFX Trading Academy

ForexTime

WallStreet Recovery PRO

BlackBull Markets

Swing Trader PRO

StarTrader

Forex VPS

MTeletool

Best Free Scalper Pro

Pepperstone

VPS Forex Trader

Evening Scalper PRO

QHoster

Telegram Copier

Happy Bitcoin

FX Secret Club

Forex Robot Academy

Trend Matrix EA

Forex Robot Factory (Expert Advisor Generator)

ByBit

Database Mart

Gold Breaker

DARKEAS

Magnetic Exchange

Quant Tekel Funded

Vortex Trader PRO

EGPForex

风险

外汇交易可能涉及超出您初始存款的损失风险。这并不适合所有投资者,您应确保了解所涉及的风险,如有必要,请寻求独立建议。

外汇账户通常提供不同程度的杠杆,其较高的利润潜力与同样高的风险水平平衡。您永远不应该冒超过您准备损失的风险,并应仔细考虑您的交易经验。

过去的表现和模拟结果并不一定表明未来的表现。本网站上的所有内容仅代表作者的意见,不构成对购买其页面中描述的任何产品的明确建议。